Total Cost of Ownership (TCO) sounds like a very abstract formula or concept. But it is in fact a very useful and transparent approach to finding out exactly what a good or service costs you. It also applies to cars. This calculation adds up all the expenses related to owning a vehicle. And we know how numerous they are. This is because the cost of a car is obviously not limited to its purchase price. All of the related or ancillary expenses must also be calculated. TCO is the only way to accurately estimate the full cost of a car. And therefore its real overall costs.

TCO calculation

The cheapest car (or the one with the largest discount) will not necessarily be the cheapest over the long term. For example, a car with a 20% discount may not be cheaper than one with a 10% discount because of its CO2 emissions and the associated taxation, a lower residual value on the second-hand market, or because of higher maintenance or running costs. This is why you should keep abreast of the market. Or at least do some research before you buy.

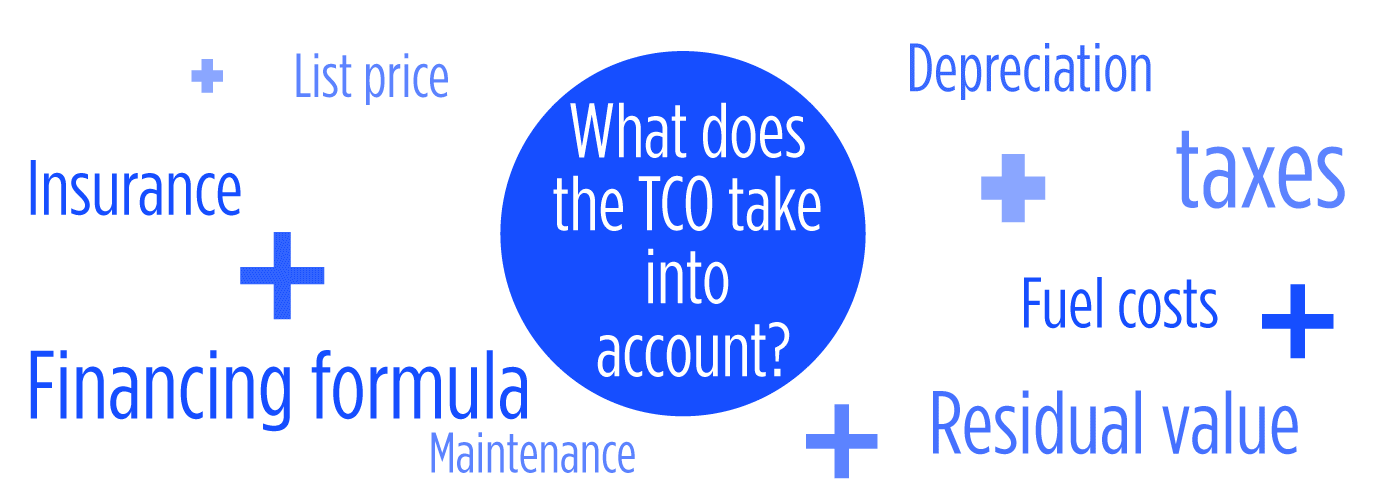

But what exactly does the TCO take into account? Well, it covers the list price, the financing formula (and therefore potential interest, advances or outstanding balance), maintenance, insurance, fuel costs, taxes, depreciation and residual value as well as depreciation for a company or which is deducted (business activity).

And for the private individual?

We know TCO is good. But is this formula also useful for private individuals? Yes, undoubtedly, even if you have to spend an evening or so doing your calculations. You should not rely solely on the sale (or purchase) price of the car, but consider other parameters, just as a fleet manager would do. A small Excel spreadsheet will help you to see more clearly and isolate costs. Note the purchase price, the cost of insurance and taxes (there are online calculators for this), evaluate your annual mileage and fuel costs (with an average price per litre of fuel; for consumption, use the tests of the specialised press or, failing that, use the urban value of the official standard), servicing and tyres. Similarly, try to estimate the residual value of the vehicle after its intended period of use. Another tip: if cost is more important than enjoyment to you, you should also find out about the reliability rating of the vehicle you are interested in. That way, you can assess the costs of the potential repairs based on the vehicle's weak points. This approach will allow you to determine the overall cost of the car you are considering more accurately and ensure it fits within your budget.